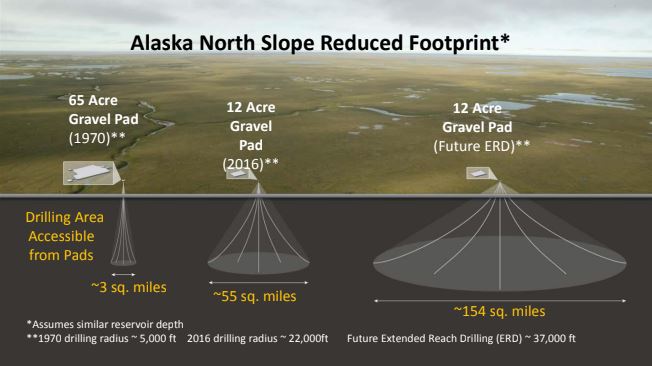

ConocoPhillips vice president Scott Jepsen says that due to improvements in lateral drilling technology — including “drilling laterals from laterals” — oil producers can develop 154 square miles of a field from a single 12-acre pad. Unfortunately, the same lateral drilling technology is also making production in the lower 48 more competitive than ever before. (ConocoPhillips image)

Contrary to projections from as recently as five years ago, oil production on Alaska’s North Slope is trending up.

Scott Jepsen, a vice-president with ConocoPhillips based in Anchorage, told the Sitka Chamber of Commerce this week (9-5-18) that improvements in drilling technology, new discoveries, and a favorable tax structure (SB 21, passed by the legislature in 2013) had all combined to steadily increase oil production — representing a reversal from his company’s 2013 outlook.

“It will come on at different times,” said ConocoPhillips VP Scott Jepsen, of his company’s new prospects on the North Slope, and the the likelihood that they could boost income for the state. “And other fields will decline. But it’s still pretty substantial revenue (for Alaska).” (KCAW photo/Robert Woolsey)

In his remarks to the Sitka Chamber, Jepsen attributed some of this change to world oil markets, and the fact that some of America’s global competitors underestimated the industry’s response to cost pressure.

Jepsen – You know we had the oil price crash starting in 2014, ‘15, ‘16, and saw prices dip below $30 a barrel when they previously had been at $100-120. I think that was one of the biggest strategic mistakes the Saudis ever made: They saw competition coming from the unconventionals and they thought, “If we flood the market, regain market share, we can drive these guys out of business. Then supply will diminish, the price will come back up, we’ll have larger market share and higher prices.” Well, the price did go down, but what they forgot about was that in a capitalistic system like ours what the people do when they see price challenges: They find ways to reduce costs. That’s what happened in our industry. Back in 2014 they had basically the cost of supply, or a break-even price for the development of the unconventionals in the range of $50-80 per barrel. Now it’s $40 per barrel or less. That’s even changed in Alaska, where the cost of supply in this timeframe was over $60 per barrel, and now it’s under $40 per barrel. So, we’ve been able to compete, and we’ve seen some remarkable increases in production.

Jepsen contrasted his company’s projections for 2013 (for production, in gray) again this year’s more optimistic trend (in red). Jepsen cited numerous reasons for the reversal, including Alaska’s controversial oil tax overhaul in 2014, known as SB 21. (ConocoPhillips image)

Jepsen told the Sitka Chamber that thanks largely to development of “unconventionals” — or shale rock — the US was poised to become the top hydrocarbon producer in the world.

But while Alaska is benefitting from the uptick, most of the growth has been in the lower 48, especially the Permian Basin on the border between Texas and New Mexico. Jepsen said this area had the potential to equal “five Prudhoe Bays.”

He called these “unconventional shale plays,” which are tapped using fracking technology, “the greatest challenge to Alaska.”

Jepsen – They really are the center of gravity right now. That’s where the vast majority of capital is being spent. And there are really an incredible number of drilling opportunities down there. There are tens of thousands of drilling opportunities in the unconventionals in the Permian Basin, North Dakota, Eagleford in South Texas, and you have a lot of companies actively exploring down there. That’s really the engine that’s driving production in the United States up as high as it is. Texas has had an incredible increase in production that’s being driven by the unconventional plays.

Nevertheless, Jepsen said that ConocoPhillips was increasing its investment in the state — hence the special trip to Sitka. He said that Conoco was buying out BP’s interest in the Kuparuk Field on the North Slope, as well as the Colville River Field — and would soon have a 100-percent interest in both. Further to the east, Jepsen said Conoco was planning to spend billions on an entirely new production facility to develop its Willow Discovery — the most promising find on the North Slope since Prudhoe Bay.

Jepsen was cautious about how these new projects would benefit state government, which continues to struggle with deficits: Although they had the potential to double the current volume of 500,000 barrels per day through the Trans Alaska Pipeline, he said, “If you assumed it came on stream at the same time — which it won’t — that’s like 400,000 barrels per day. It will come on at different times, other fields will decline…. Still, it will be pretty substantial revenue.”